Stock Forecasting with LSTM

Introduction

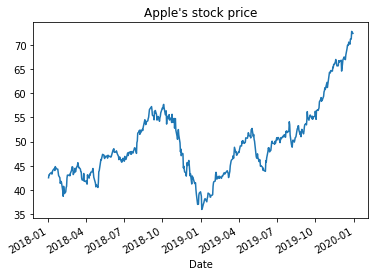

As indicated in a previous blog post, time-series models are designed to predict future values based on previously observed values. In other words the input is a signal (time-series) that is defined by observations taken sequentially in time. However, time-series forecasting models such as ARIMA has it own limitations when it comes to non-stationary data (i.e. where statistical properties e.g. the mean and standard deviation are not constant over time but instead, these metrics vary over time). An examples of non-stationary time-series stock price (not to be confused with stock returns) over time.

As discussed in a previous blog post here there have been attempts to predict stock outcomes (e.g. price, return. etc.) using time series analysis algorithms, though the performance is sub par and cannot be used to efficiently predict the market. It is noteworthy that this is a technical tutorial and does not intent to guide people into buying stocks.

LSTM

The LSTM stands for Long Short-Term Memory a member of recurrent neural network (RNN) family used for sequence data in deep learning. Unlike standard feedforward fully connected neural network layers, RNNs and here LSTM have feedback loops which enables them to store information over a period of time also reffered to as a memory capacity.

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import pandas as pd

from sklearn.preprocessing import MinMaxScaler

import yfinance as yf

from yahoofinancials import YahooFinancials

%matplotlib inline

The first step is to download the data from Yahoo finance. In the first step we focus on the Apple stock.

appl_df = yf.download('AAPL',

start='2018-01-01',

end='2019-12-31',

progress=False)

appl_df.head()

| Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2018-01-02 | 42.540001 | 43.075001 | 42.314999 | 43.064999 | 41.380238 | 102223600 |

| 2018-01-03 | 43.132500 | 43.637501 | 42.990002 | 43.057499 | 41.373032 | 118071600 |

| 2018-01-04 | 43.134998 | 43.367500 | 43.020000 | 43.257500 | 41.565216 | 89738400 |

| 2018-01-05 | 43.360001 | 43.842499 | 43.262501 | 43.750000 | 42.038452 | 94640000 |

| 2018-01-08 | 43.587502 | 43.902500 | 43.482498 | 43.587502 | 41.882305 | 82271200 |

and to plot it using pandas plotting function.

appl_df['Open'].plot(title="Apple's stock price")

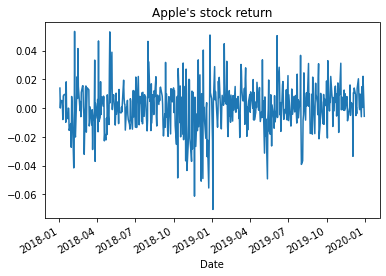

here we covert the stock price to daily stock returns and to plot it

appl_df['Open']=appl_df['Open'].pct_change()

appl_df['Open'].plot(title="Apple's stock return")

From previous experience with deep learning models, we know that we have to scale our data for optimal performance. In our case, we’ll use Scikit- Learn’s StandardScaler and scale our dataset to numbers between zero and one.

sc = StandardScaler()

here we create a univariate pre-processor function that does three steps of min max scaling, creating lags, and separating the data to train and test sets for a given time-series.

def preproc( data, lag, ratio):

data=data.dropna().iloc[:, 0:1]

Dates=data.index.unique()

data.iloc[:, 0] = sc.fit_transform(data.iloc[:, 0].values.reshape(-1, 1))

for s in range(1, lag):

data['shift_{}'.format(s)] = data.iloc[:, 0].shift(s)

X_data = data.dropna().drop(['Open'], axis=1)

y_data = data.dropna()[['Open']]

index=int(round(len(X_data)*ratio))

X_data_train=X_data.iloc[:index,:]

X_data_test =X_data.iloc[index+1:,:]

y_data_train=y_data.iloc[:index,:]

y_data_test =y_data.iloc[index+1:,:]

return X_data_train,X_data_test,y_data_train,y_data_test,Dates;

Then we apply the univariate pre-processing to the Apple data

a,b,c,d,e=preproc(appl_df, 25, 0.90)

As a second ticker and an additional varaible to improve our model performance we focus of the SP500 index eft SPY.

spy_df = yf.download('SPY',

start='2018-01-01',

end='2019-12-31',

progress=False)

spy_df.head()

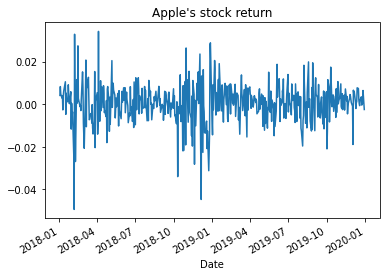

here we covert the stock price to daily stock returns and to plot it

spy_df['Open']=spy_df['Open'].pct_change()

spy_df['Open'].plot(title="Apple's stock return")

here we create a multi-variate pre-processor function that does three steps of min max scaling, creating lags, and separating the data to train and test sets for common dates of two time series.

def preproc2( data1, data2, lag, ratio):

common_dates=list(set(data1.index) & set(data2.index))

data1=data1[data1.index.isin(common_dates)]

data2=data2[data2.index.isin(common_dates)]

X1=preproc(data1, lag, ratio)

X2=preproc(data2, lag, ratio)

return X1,X2;

Then we apply the multi-variate pre-processing to both SPY and Apple data

dataLSTM=preproc2( spy_df, appl_df, 25, 0.90)

here we load necessary libraries for the deep learning model

from keras.models import Sequential

from keras.layers import Dense

from keras.layers import LSTM

import keras.backend as K

from keras.callbacks import EarlyStopping

in order to run the models data should be transformed to numpy arrays

a = a.values

b= b.values

c = c.values

d = d.values

and properly reshaped for LSTM modeling

X_train_t = a.reshape(a.shape[0], 1, 24)

X_test_t = b.reshape(b.shape[0], 1, 24)

here we define a simple Sequential model with two LSTM and two dense layers

K.clear_session()

early_stop = EarlyStopping(monitor='loss', patience=1, verbose=1)

model = Sequential()

model.add(LSTM(12, input_shape=(1, 24), return_sequences=True))

model.add(LSTM(6))

model.add(Dense(6))

model.add(Dense(1))

model.compile(loss='mean_squared_error', optimizer='adam')

that we train for 100 epochs

model.fit(X_train_t, c,

epochs=100, batch_size=1, verbose=1,

callbacks=[early_stop])

Epoch 1/100

429/429 [==============================] - 2s 1ms/step - loss: 1.3043

Epoch 2/100

429/429 [==============================] - 0s 1ms/step - loss: 0.9467

...

Epoch 00029: early stopping

Here we create a rolling forecast function that predicts the values based on the previous outcomes of the model.

ypredr=[]

st=X_test_t[0].reshape(1, 1, 24)

tmp=st

ptmp=st

val=model.predict(st)

ypredr.append(val.tolist()[0])

for i in range(1, X_test_t.shape[0]):

tmp=np.append(val, tmp[0,0, 0:-1])

tmp=tmp.reshape(1, 1, 24)

ptmp=np.vstack((ptmp,tmp))

val=model.predict(tmp)

ypredr.append(val.tolist()[0])

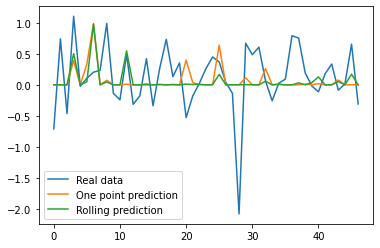

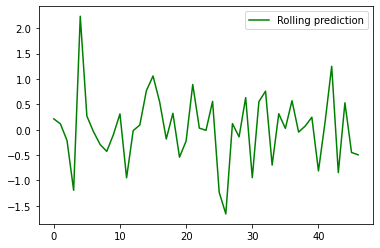

the plot here shows the rolling forecast which base each forecast on 24 data points forecasted beforehand, this should be contrasted to the one point forecast function that base each forecast on 24 data points observed beforehand.

plt.plot(ypredr,color="green", label = "Rolling prediction")

plt.legend()

plt.show()

y_pred = model.predict(X_test_t)

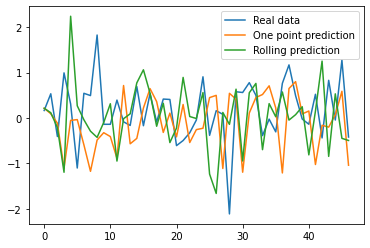

plt.plot(d, label = "Real data")

plt.plot(y_pred, label = "One point prediction")

plt.plot(ypredr, label = "Rolling prediction")

plt.legend()

plt.show()

here we move to multivariate models. First, to run the models data should be transformed to numpy arrays.

here we move to multivariate models. First, to run the models data should be transformed to numpy arrays.

Aa = dataLSTM[0][0].values

Ab = dataLSTM[0][1].values

Ac = dataLSTM[0][2].values

Ad = dataLSTM[0][3].values

X_train_A = Aa.reshape(Aa.shape[0], 1, 24)

X_test_A = Ab.reshape(Ab.shape[0], 1, 24)

Sa = dataLSTM[1][0].values

Sb = dataLSTM[1][1].values

Sc = dataLSTM[1][2].values

Sd = dataLSTM[1][3].values

X_train_S = Sa.reshape(Sa.shape[0], 1, 24)

X_test_S = Sb.reshape(Sb.shape[0], 1, 24)

here we load necessary libraries for the deep learning model

from keras.layers import concatenate

from keras.layers import Dropout

from keras.layers import Dense

import keras.backend as K

from keras.callbacks import EarlyStopping

from keras.layers import LSTM

from keras.models import Input, Model

from keras.layers import Dense

here we define model with Keras functional API using two LSTM layers concatenated together and two dense layers with drop out.

early_stop = EarlyStopping(monitor='loss', patience=1, verbose=1)

input1 = Input(shape=(1,24)) # for the three columns of dat_train

x1 = LSTM(6)(input1)

input2 = Input(shape=(1,24))

x2 = LSTM(6)(input2)

con = concatenate(inputs = [x1,x2] ) # merge in metadata

x3 = Dense(50)(con)

x3 = Dropout(0.3)(x3)

output = Dense(1, activation='sigmoid')(x3)

n_net = Model(inputs=[input1, input2], outputs=output)

n_net.compile(loss='mean_squared_error', optimizer='adam')

and to train the model for 100 epochs

n_net.fit(x=[X_train_A, X_train_S], y=Ac, epochs=100, batch_size=1, verbose=1,

callbacks=[early_stop])

Epoch 1/100

429/429 [==============================] - 0s 832us/step - loss: 0.7942

Epoch 2/100

429/429 [==============================] - 0s 808us/step - loss: 0.7825

...

Epoch 14/100

429/429 [==============================] - 0s 802us/step - loss: 0.7143

Epoch 00014: early stopping

```

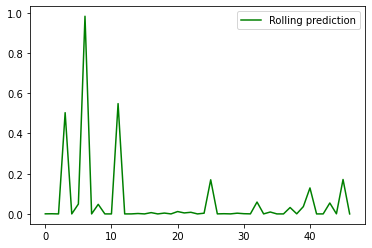

the plot here shows the rolling forecast which base each forecast on 24

data points forecasted beforehand, this should be contrasted to the one

point forecast function that base each forecast on 24 data points

observed beforehand.

``` {.python}

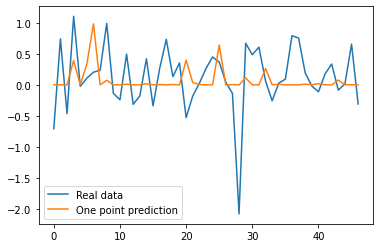

y_pred = n_net.predict([X_test_A,X_test_S])

plt.plot(Ad, label = "Real data")

plt.plot(y_pred, label = "One point prediction")

plt.legend()

plt.show()

ypredr=[]

st=X_test_A[0].reshape(1, 1, 24)

sst=X_test_S[0].reshape(1, 1, 24)

tmp=st

ptmp=st

val=n_net.predict([tmp,sst])

ypredr.append(val.tolist()[0])

for i in range(1, X_test_t.shape[0]):

tmp=np.append(val, tmp[0,0, 0:-1])

tmp=tmp.reshape(1, 1, 24)

sst=X_test_S[i].reshape(1, 1, 24)

ptmp=np.vstack((ptmp,tmp))

val=n_net.predict([tmp,sst])

ypredr.append(val.tolist()[0])

plt.plot(ypredr, color="green", label = "Rolling prediction")

plt.legend()

plt.show()

y_pred = n_net.predict([X_test_A,X_test_S])

plt.plot(Ad, label = "Real data")

plt.plot(y_pred, label = "One point prediction")

plt.plot(ypredr, label = "Rolling prediction")

plt.legend()

plt.show()