Introduction

As discussed in a previous blog post here there have been attempts to predict stock outcomes (e.g. price, return, etc.) using recurrent neural networks and more specifically LSTMs. The LSTM stands for Long Short-Term Memory a member of recurrent neural network (RNN) family used for sequence data in deep learning. Unlike standard feedforward fully connected neural network layers, RNNs and here LSTM have feedback loops which enables them to store information over a period of time also referred to as a memory capacity. The example above showed that the performance is sub par and cannot be used to efficiently predict the market. One approach is to tune hyperparameters of the network such as the number of layers, activation functions, and regularization. This tutorial aims to highlight the use of the Keras Tuner package to tune a LSTM network for time series analysis. It is noteworthy that this is a technical tutorial and does not intent to guide people into buying stocks.

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import pandas as pd

from sklearn.preprocessing import StandardScaler

import yfinance as yf

from yahoofinancials import YahooFinancials

%matplotlib inline

The first step is to download the data from Yahoo finance. In the first step we focus on the Apple stock.

appl_df = yf.download('AAPL',

start='2019-01-01',

end='2020-12-31',

progress=False)

appl_df.head()

| Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2018-01-02 | 42.540001 | 43.075001 | 42.314999 | 43.064999 | 41.380238 | 102223600 |

| 2018-01-03 | 43.132500 | 43.637501 | 42.990002 | 43.057499 | 41.373032 | 118071600 |

| 2018-01-04 | 43.134998 | 43.367500 | 43.020000 | 43.257500 | 41.565216 | 89738400 |

| 2018-01-05 | 43.360001 | 43.842499 | 43.262501 | 43.750000 | 42.038452 | 94640000 |

| 2018-01-08 | 43.587502 | 43.902500 | 43.482498 | 43.587502 | 41.882305 | 82271200 |

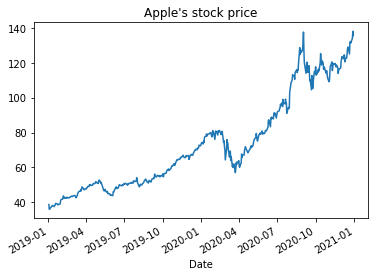

and to plot it using pandas plotting function.

appl_df['Open'].plot(title="Apple's stock price")

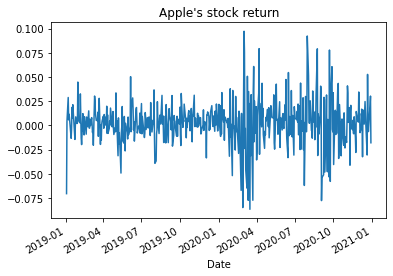

here we covert the stock price to daily stock returns and to plot it

appl_df['Open']=appl_df['Open'].pct_change()

appl_df['Open'].plot(title="Apple's stock return")

From previous experience with deep learning models, we know that we have to scale our data for optimal performance. In our case, we’ll use Scikit- Learn’s StandardScaler and scale our dataset to numbers between zero and one.

sc = StandardScaler()

here we create a univariate pre-processor function that does three steps of min max scaling, creating lags, and separating the data to train and test sets for a given time-series.

def preproc( data, lag, ratio):

data=data.dropna().iloc[:, 0:1]

Dates=data.index.unique()

data.iloc[:, 0] = sc.fit_transform(data.iloc[:, 0].values.reshape(-1, 1))

for s in range(1, lag):

data['shift_{}'.format(s)] = data.iloc[:, 0].shift(s)

X_data = data.dropna().drop(['Open'], axis=1)

y_data = data.dropna()[['Open']]

index=int(round(len(X_data)*ratio))

X_data_train=X_data.iloc[:index,:]

X_data_test =X_data.iloc[index+1:,:]

y_data_train=y_data.iloc[:index,:]

y_data_test =y_data.iloc[index+1:,:]

return X_data_train,X_data_test,y_data_train,y_data_test,Dates;

Then we apply the univariate pre-processing to the Apple data

a,b,c,d,e=preproc(appl_df, 25, 0.90)

in order to run the models data should be transformed to numpy arrays

a = a.values

b= b.values

c = c.values

d = d.values

and properly reshaped for LSTM modeling

X_train_t = a.reshape(a.shape[0], 1, 24)

X_test_t = b.reshape(b.shape[0], 1, 24)

from keras.models import Sequential

from keras.layers import Dense

from keras.layers import LSTM

import keras.backend as K

from keras.callbacks import EarlyStopping

import keras_tuner as kt

from tensorflow.keras.layers import Dropout

from keras_tuner.tuners import RandomSearch

from keras_tuner.engine.hyperparameters import HyperParameters

here we define a simple Sequential model with two LSTM and two dense layers

K.clear_session()

early_stop = EarlyStopping(monitor='loss', patience=1, verbose=1)

model = Sequential()

model.add(LSTM(12, input_shape=(1, 24), return_sequences=True))

model.add(LSTM(6))

model.add(Dense(6))

model.add(Dense(1))

model.compile(loss='mean_squared_error', optimizer='adam')

and fit the model

model.fit(X_train_t, c,

epochs=100, batch_size=1, verbose=1,

callbacks=[early_stop])

Epoch 1/100

431/431 [==============================] - 2s 973us/step - loss: 0.9624

Epoch 2/100

431/431 [==============================] - 0s 947us/step - loss: 1.0980

Epoch 3/100

431/431 [==============================] - 0s 947us/step - loss: 0.9530

Epoch 4/100

431/431 [==============================] - 0s 945us/step - loss: 0.8867

Epoch 5/100

431/431 [==============================] - 0s 943us/step - loss: 0.8433

Epoch 6/100

431/431 [==============================] - 0s 942us/step - loss: 0.5886

Epoch 7/100

431/431 [==============================] - 0s 956us/step - loss: 0.6192

Epoch 8/100

431/431 [==============================] - 0s 973us/step - loss: 0.5257

Epoch 9/100

431/431 [==============================] - 0s 957us/step - loss: 0.4120

Epoch 10/100

431/431 [==============================] - 0s 946us/step - loss: 0.3625

Epoch 11/100

431/431 [==============================] - 0s 944us/step - loss: 0.3114

Epoch 12/100

431/431 [==============================] - 0s 943us/step - loss: 0.3296

Epoch 13/100

431/431 [==============================] - 0s 944us/step - loss: 0.2298

Epoch 14/100

431/431 [==============================] - 0s 945us/step - loss: 0.2337

Epoch 15/100

431/431 [==============================] - 0s 945us/step - loss: 0.2314

Epoch 16/100

431/431 [==============================] - 0s 942us/step - loss: 0.2489

Epoch 17/100

431/431 [==============================] - 0s 940us/step - loss: 0.2131

Epoch 18/100

431/431 [==============================] - 0s 943us/step - loss: 0.1688

Epoch 19/100

431/431 [==============================] - 0s 947us/step - loss: 0.1759

Epoch 20/100

431/431 [==============================] - 0s 974us/step - loss: 0.1767

Epoch 21/100

431/431 [==============================] - 0s 1ms/step - loss: 0.1603

Epoch 22/100

431/431 [==============================] - 1s 1ms/step - loss: 0.1526

Epoch 23/100

431/431 [==============================] - 0s 1ms/step - loss: 0.1666

Epoch 24/100

431/431 [==============================] - 0s 945us/step - loss: 0.1575

Epoch 00024: early stopping

This is in contrast to the tuner approach where options for hyper parameters “hp” are specified and passed to the model

def build_model(hp):

model = Sequential()

model.add(LSTM(hp.Int('input_unit',min_value=32,max_value=128,step=32),return_sequences=True, input_shape=(1,24)))

for i in range(hp.Int('n_layers', 1, 10)):

model.add(LSTM(hp.Int(f'lstm_{i}_units',min_value=32,max_value=128,step=32),return_sequences=True))

model.add(LSTM(6))

model.add(Dropout(hp.Float('Dropout_rate',min_value=0,max_value=0.5,step=0.1)))

model.add(Dense(6))

model.add(Dropout(hp.Float('Dropout_rate',min_value=0,max_value=0.5,step=0.1)))

model.add(Dense(1))

model.compile(loss='mean_squared_error', optimizer='adam',metrics = ['mse'])

return model

Thereafter the tuner object is defined here we use the RandomSearch but other options are available as well.

tuner= kt.RandomSearch(

build_model,

objective='mse',

max_trials=10,

executions_per_trial=3

)

and instead of fitting the model you run the search function on the tuner object.

tuner.search(

x=X_train_t,

y=c,

epochs=20,

batch_size=128,

validation_data=(X_test_t,d),

)

Trial 10 Complete [00h 00m 17s]

mse: 0.8778028885523478

Best mse So Far: 0.8115118543306986

Total elapsed time: 00h 02m 14s

INFO:tensorflow:Oracle triggered exit

Once the hyper parameter training is done it is possible to get the best model

best_model = tuner.get_best_models(num_models=1)[0]

information on the architecture

best_model.summary()

Model: "sequential"

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

lstm (LSTM) (None, 1, 64) 22784

_________________________________________________________________

lstm_1 (LSTM) (None, 1, 64) 33024

_________________________________________________________________

lstm_2 (LSTM) (None, 1, 96) 61824

_________________________________________________________________

lstm_3 (LSTM) (None, 6) 2472

_________________________________________________________________

dropout (Dropout) (None, 6) 0

_________________________________________________________________

dense (Dense) (None, 6) 42

_________________________________________________________________

dropout_1 (Dropout) (None, 6) 0

_________________________________________________________________

dense_1 (Dense) (None, 1) 7

=================================================================

Total params: 120,153

Trainable params: 120,153

Non-trainable params: 0

_________________________________________________________________

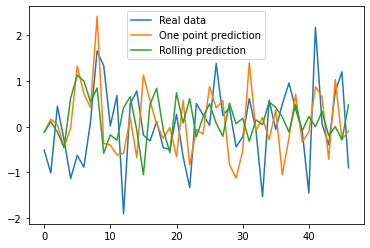

as well as evaluating the performance, here we use the same visualizing approach as discussed in a previous blog post here.

ypredr=[]

st=X_test_t[0].reshape(1, 1, 24)

tmp=st

ptmp=st

val=model.predict(st)

ypredr.append(val.tolist()[0])

for i in range(1, X_test_t.shape[0]):

tmp=np.append(val, tmp[0,0, 0:-1])

tmp=tmp.reshape(1, 1, 24)

ptmp=np.vstack((ptmp,tmp))

val=model.predict(tmp)

ypredr.append(val.tolist()[0])

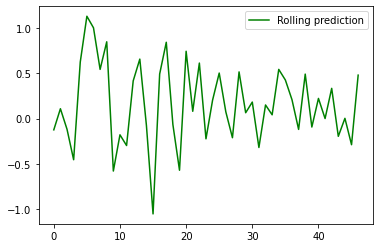

plt.plot(ypredr,color="green", label = "Rolling prediction")

plt.legend()

plt.show()

y_pred = model.predict(X_test_t)

plt.plot(d, label = "Real data")

plt.plot(y_pred, label = "One point prediction")

plt.plot(ypredr, label = "Rolling prediction")

plt.legend()

plt.show()